Discover 5 effective forex trading strategies to boost your profitability and navigate the market with confidence. From trend following to breakout and Fibonacci retracement, learn key techniques to enhance your trading performance. In this comprehensive guide, we’ll explore five proven forex trading strategies that have stood the test of time, offering you valuable insights and practical techniques to enhance your trading performance.

1. Trend Following Strategy

One of the most popular and straightforward forex trading strategies is trend following. This strategy involves identifying the direction of the prevailing trend and trading in alignment with it. Traders often use technical indicators such as moving averages or trendlines to confirm the trend’s direction and filter out noise from market fluctuations.

To implement a trend-following strategy effectively, traders wait for a clear trend to establish itself and then enter positions in the direction of the trend. They aim to ride the trend for as long as possible, capturing significant price movements and maximizing profits while minimizing losses through proper risk management techniques like trailing stops.

2. Breakout Strategy

The breakout strategy capitalizes on significant price movements that occur when price breaks out of a predefined trading range or chart pattern, such as a triangle or rectangle. Traders identify key support and resistance levels and wait for price to break decisively above or below these levels, signaling a potential trend continuation or reversal.

To trade breakouts successfully, traders often use stop orders to enter positions once the breakout occurs, ensuring they capture the momentum of the price movement. They also employ risk management techniques to protect against false breakouts and minimize losses if the trade doesn’t follow through as expected.

3. Range Trading Strategy

Range trading, also known as mean reversion trading, involves identifying periods of consolidation or sideways movement in the forex market and trading within the established range. Traders look for opportunities to buy near the bottom of the range and sell near the top, profiting from price oscillations within the range-bound market.

To implement a range trading strategy effectively, traders use technical indicators like oscillators (e.g., RSI, Stochastic) to identify overbought and oversold conditions within the range. They set buy and sell orders at key support and resistance levels and employ tight stop-loss orders to manage risk and protect against potential breakouts.

4. Fibonacci Retracement Strategy

The Fibonacci retracement strategy is based on the principle of Fibonacci ratios, which are mathematical relationships found in nature and often observed in financial markets. Traders use Fibonacci retracement levels to identify potential areas of support and resistance where the price is likely to reverse or consolidate.

To apply the Fibonacci retracement strategy, traders identify a significant price move (swing high to swing low or vice versa) and plot Fibonacci retracement levels based on this move. They then look for confluence between Fibonacci levels and other technical indicators to identify high-probability trading opportunities, such as trend continuation or reversal setups.

5. Price Action Trading Strategy

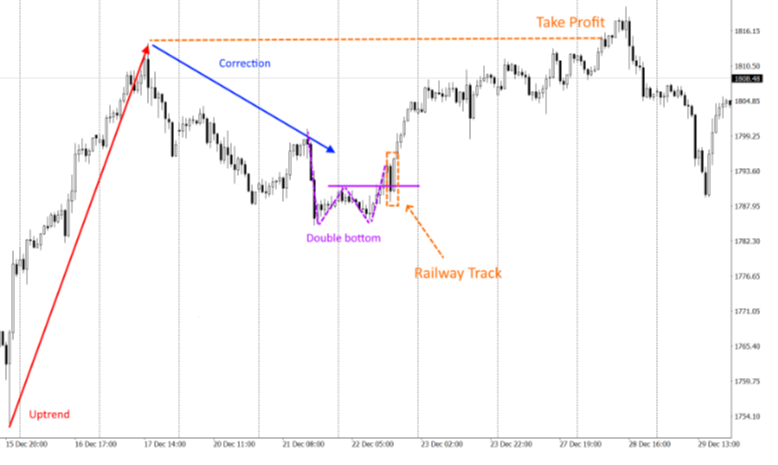

Price action trading is a versatile approach that focuses on analyzing raw price movements without the use of indicators or oscillators. Traders observe candlestick patterns, chart patterns, and key support and resistance levels to make trading decisions based on price action alone.

To master price action trading, traders develop a keen understanding of market dynamics and learn to interpret price action signals effectively. They look for patterns such as pin bars, engulfing patterns, and inside bars, which indicate potential reversals or continuations in price.

Conclusion

Mastering forex trading requires a combination of knowledge, skill, and discipline, along with effective trading strategies tailored to your trading style and risk tolerance. By incorporating these five proven strategies into your trading arsenal and honing your skills through practice and experience, you can increase your chances of success in the competitive world of forex trading. Remember to always prioritize risk management, adaptability, and continuous learning as you navigate the complexities of the forex market. With dedication and perseverance, you can unlock the potential for consistent profitability and achieve your trading goals.